Parcel Tax Senior Exemption Waiver Information

UPDATE: 6/17/24

Deadline for filing for the 2024-2025 tax year was June 15, 2024, 4:30 pm.

No retroactive refunds will be provided. The application is only for "First Time Applicants". Currently exempted persons do not have to file a new application.

If you would like more information please contact supsub@fusdk12.net.

Frequently Asked Questions & Answers

Q: When does Fremont Unified School District start and finish accepting exemption applications?

A: We accept applications yearly starting mid January through mid June (deadline is stated on the application).

Q: Who is eligible for the exemption?

A: Any Fremont homeowner 65 years of age or older that meets the required documentation. Please note: homeowner’s name must also appear on the current Property Tax Statement and must be the primary residence. And homeowner at any age with verified Supplemental Security Income (SSI) or Social Security Disability Insurance (SSDI).

Q: Where does the information go once I submit documents?

A: After reviewing required documents, we only send the homeowner’s name and parcel number to a 3rd party vendor who works with the Alameda County Tax Collector’s office. All other required information that gets sent into the District office stays in a secured location.

Q: Do I need to apply for the exemption waiver every year?

A: Those with an exemption do not need to renew each year.

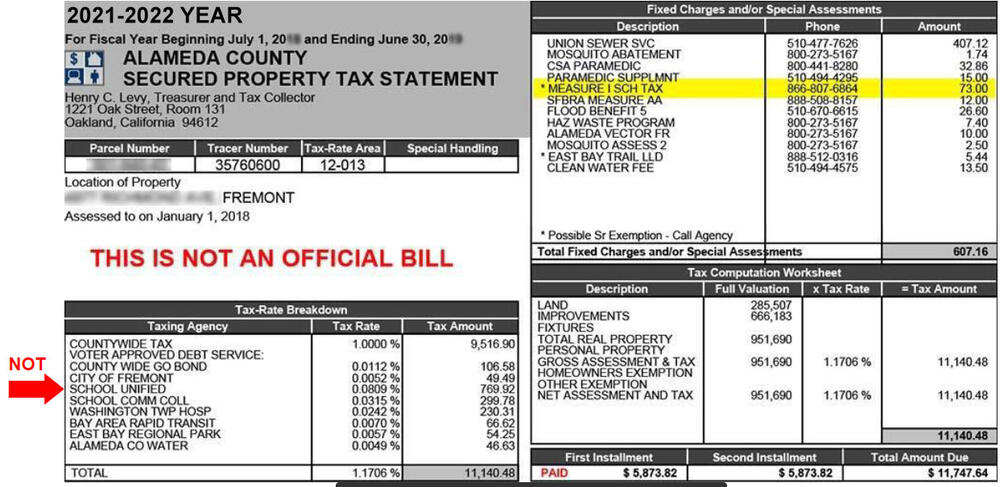

Q: Can I also get an exemption for SCHOOL UNIFIED tax on lower left side of bill (see red arrow)?

A: No, the Measure I Parcel tax exemption is only for MEASURE I SCH TAX for $73 listed on the upper right of your statement. If you do not see it listed you are already exempt in which case you do not need to reapply.

The highlighted area below is the only Exemption available - if you do not see the words Measure I you are already exempt.

About Measure I

Measure I was approved in by Fremont voters on June 7, 2016 by more than a 2-to-1 margin; the local funding continuation measure renews the previous Measure K (approved by voters in 2010) at an adjusted annual rate of $73.00, per parcel, for nine years to provide additional resources to help local schools continue attracting and retaining highly-qualified teachers, including science teachers, for 21st century education, maintaining math, reading and writing programs and protecting student safety and security.

Measure I extends the expiring voter approved funding at a $73 per parcel rate for nine years to:

- Maintain math and science programs

- Maintain reading and writing programs

- Retain quality science teachers for 21st century science education

- Attract and retain highly qualified teachers

- Relieve overcrowding in classrooms

- Keep school libraries open

- Maintain programs to prepare students for the workforce

- Protect student safety and security

Measure I Ballot Text

EXHIBIT B

*START OF FULL BALLOT TEXT*

Fremont Unified School District

Quality Education and Local Control Funding Measure I

INTRODUCTION AND PURPOSE

To continue funding for core programs in math, science and reading, provide local reliable funding for local schools that cannot be taken by the State, attract and retain highly-qualified teachers including quality science teachers, maintain math, science, reading and writing programs, keep school libraries open, relieve overcrowding in classrooms, maintain programs to prepare students for the workforce, and protect student safety and security, with no proceeds used for administrators’ salaries, benefits and pensions, the Fremont Unified School District (“District”) proposes to renew and extend its expiring voter approved education and local control parcel tax for a period of nine years from starting date of July 1, 2016 at a rate of $73 per parcel per year (the existing Measure K which expires on December 10, 2016 shall be replaced by this Measure starting July 1, 2016), with an exemption available for senior citizens and certain disabled persons, and to implement accountability measures, including citizen oversight, to ensure the funds are used to help:

- Attract and retain highly-qualified teachers including quality science teachers;

- Protect quality academic instruction in core subjects like math, science, reading and writing;

- Relieve overcrowding in classrooms;

- Keep school libraries open;

- Maintain programs to prepare students for the workforce; and

- Protect student safety and security.

The proceeds of the parcel tax shall be deposited into a separate account created by the District.

DEFINITION OF “PARCEL”

For purposes of the high quality education parcel tax, the term “Parcel” means any parcel of land which lies wholly or partially within the boundaries of the Fremont Unified School District, that receives a separate tax bill for ad valorem property taxes from the Alameda County Assessor/Tax Collector, as applicable. All property that is otherwise exempt from or upon which are levied no ad valorem property taxes in any year shall also be exempt from the education and local control parcel tax in such year.

For purposes of this education and local control parcel tax, any such “Parcels” which are (i) contiguous, and (ii) used solely for owner-occupied, single-family residential purposes, and (iii) held under identical ownership may, by submitting to the District an application of the owners thereof by June 15 of any year, be treated as a single “parcel” for purposes of the levy of the high quality education and local control parcel tax.

EXEMPTION FOR SENIORS AND SSI RECIPIENTS

Pursuant to California Government Code Section 50079 (b)(1), any owner of a Parcel used solely for owner-occupied, single-family residential purposes and who are either (a) 65 years of age or older on or before June 30 of the fiscal year immediately preceding the year in which the tax would apply, or (b) persons receiving Supplemental Security Income for a disability, regardless of age, or (c) receiving Social Security Disability Insurance benefits, regardless of age, whose yearly income does not exceed 250 percent of the 2012 federal poverty guidelines issued by the United States Department of Health and Human Services, may obtain an exemption from the parcel tax by submitting an application therefore, by June 15 of any year, to the District.

Persons who are owners of Parcels used solely for owner-occupied, single-family residential purposes and currently exempted from the District’s expiring Measure K parcel tax shall automatically be exempted from this Measure without having to file a new application.

The District may establish administrative procedures to periodically verify the continuance of any previously granted exemption.

With respect to all general property tax matters within its jurisdiction, the Alameda County Treasurer and Tax Collector or other appropriate county tax officials, shall make all final determinations of tax exemption or relief for any reason, and that decision shall be final and binding. With respect to matters specific to the levy of the high quality education and local control parcel tax, including any exemptions and the classification of property for purposes of calculating the tax, the decisions of the District shall be final and binding.

REDUCTION IN TAX IF RESULT IS LESS OTHER GOVERNMENT SUPPORT

The collection of the education and local control parcel tax is not intended to decrease or offset any increase in local, state or federal government revenue sources that would otherwise be available to the District during the period of the parcel tax. In the event that the levy and collection does have such an effect, the District may cease the levy or shall reduce the parcel tax to the extent that such action would restore the amount of the decrease or offset in other revenues.

ACCOUNTABILITY MEASURES

In accordance with the requirements of California Government Code Sections 50075.1 and 50075.3, the following accountability measures, among others, shall apply to the parcel tax levied in accordance with this Measure: (a) the specific purposes of the parcel tax shall be those purposes identified above; (b) the proceeds of the parcel tax shall be applied only to those specific purposes identified above; (c) a separate, special account shall be created into which the proceeds of the education and local control parcel tax must be deposited; and (d) an annual written report shall be made to the Board of Education of the District showing (i) the amount of funds collected and expended from the proceeds of the high quality education and local control parcel tax and (ii) the status of any projects or programs required or authorized to be funded from the proceeds of the parcel tax, as identified above. In addition to the accountability measures required by law, the District will maintain its existing Citizens’ Oversight Committee to provide oversight as to the expenditure of parcel tax revenues.

*End of Full Ballot Text of Measure*